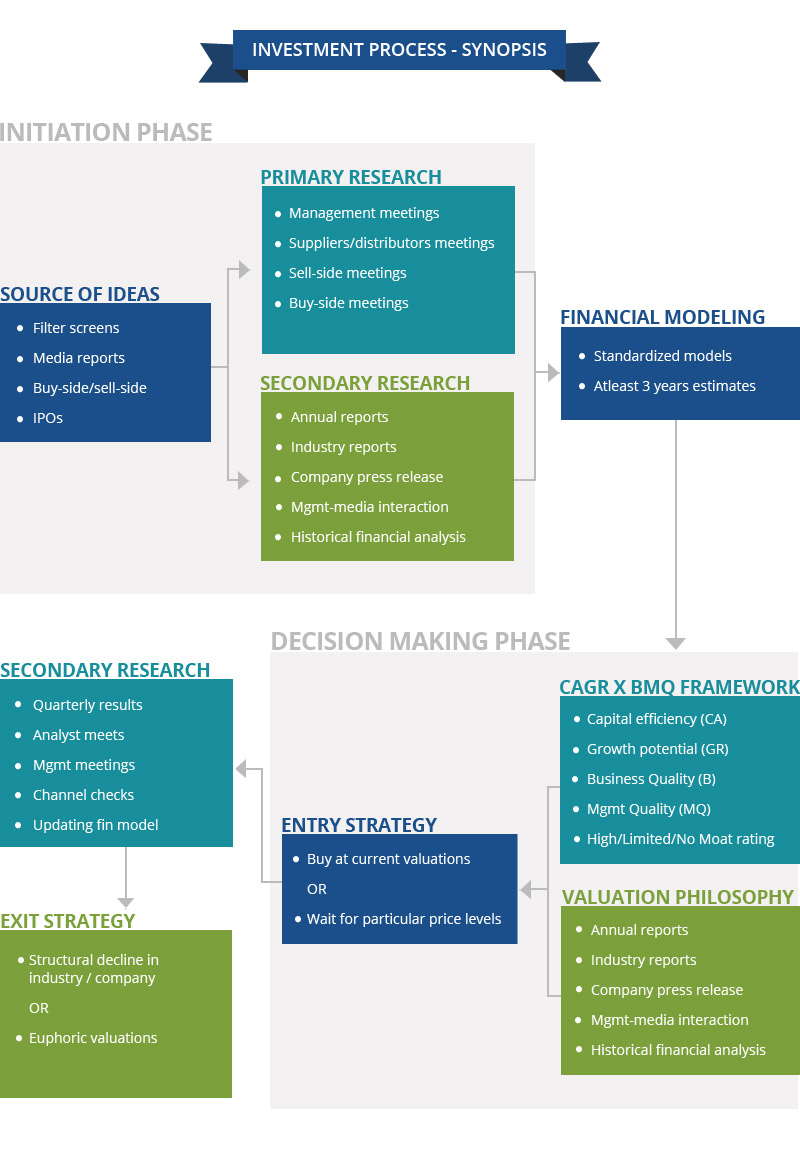

At Anived, we believe stock selection is as much an art as it is a science. Being bottom-up investors the starting point to our research process is a company. The research team uses multiple sources to shortlist names for further research. The most important of these are filter screens where the companies are shortlisted based on well-defined objective criteria such as sector, market capitalization, RoE, RoIC, profit margin, earnings growth, valuations, etc. The next stages are that of primary and secondary research once the shortlist is prepared.

Secondary research involves going thru annual reports, industry reports and other data that is publicly available related to the company. An analysis of historical financials is also done to understand the past growth trends and capital efficiency. Primary research involves meeting the management and understanding their vision and future roadmap for the company. To get a deeper understanding of company’s strengths and weaknesses, we undertake ground-level research which involves meetings with suppliers, distributors, customers and competitors of the company. We also meet brokers and other institutional investors to get a feeling on how do our peers view the company. The outcome of primary and secondary research is answers to following questions:

- History and track record of the company and promoters – both in running the business and towards corporate governance.

- What is the industry in which it operates and what are the realistic prospects and threats for the industry?

- What is the company’s position in the industry and its moats and weak flanks?

- Translating the above into future estimates for the company.