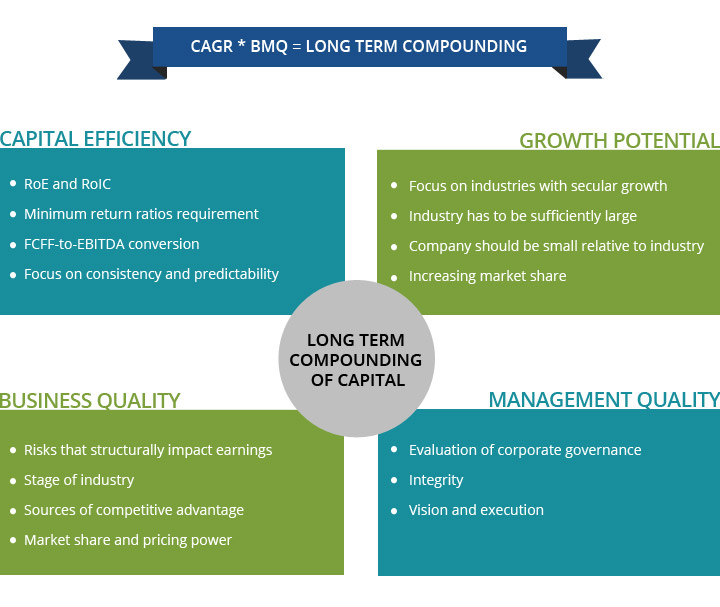

The bedrocks of our investment philosophy are compounding and preservation of capital. Our success depends heavily on identifying high quality companies as investments. To achieve this, we rely on our proprietary investment framework – CAGR * BMQ. This framework rests on five important pillars that are representative of growth potential of the company relative to its industry, management’s capability to capitalize on these opportunities and margin of safety offered by valuations. The pillars are – growth potential, capital efficiency, business quality, management quality and valuations. The first four parameters are business related whereas valuations determine entry/exit strategy for investment purposes.

In CAGR * BMQ, ‘CA’ stands for capital efficiency, ‘GR’ for growth potential and ‘BMQ’ for business and management quality. CAGR constitutes of quantitative factors and gives an objective analysis of the company. Whereas, BMQ constitutes of qualitative factors and offers a subjective view of the company. Based on our analysis of these business-related parameters, we classify the companies into quality categories – ‘High Moat’, ‘Limited Moat’ and ‘No Moat’.